Beauty Parlor Kit Sahay Yojana 2023: Fill Online Form Here.

Beauty Parlor Kit Sahay Yojana 2023: Fill Online Form Here

What is Home Loan?

Home loan is a form of secured loan that is availed by a customer to purchase a house. The property can be an under-construction or a ready property from a developer, purchase of a resale property, to construct a housing unit on a plot of land, to make improvements and extensions to an already existing house and to transfer your existing home loan availed from another financial institution to HDFC. A housing loan is repaid through equated monthly installments (EMI) which consists of a portion of the principal borrowed and the interest accrued on the same

How do I apply for a home loan?

You can avail a HDFC home loan online in 4 quick and easy steps:

1. Sign Up / Register

2. Fill in the home loan application form

3. Upload Documents

4. Pay Processing Fee

5. Get Loan Approval

What is the maximum home loan that I can obtain?

You are required to pay 10-25% of the total property cost as ‘own contribution depending upon the loan amount. 75 to 90% of the property cost is what can be availed as a housing loan. In case of construction, home improvement and home extension loans, 75 to 90% of the construction/improvement/extension estimate can be funded.

You can also apply for a home loan online. Visit https://portal.hdfc.com/ to apply now!.

Do I get tax benefits on my housing loan?

Yes. You may be eligible for tax benefits on repayment of the principal and interest components of your Home Loan as per sections 80C, 24(b) and 80EEA of the Income Tax Act, 1961. Since the benefits may vary each year, please do consult your chartered accountant/ tax expert for the latest information.

Table of Contents

Beauty Parlor Kit Assistance Scheme 2023

Beauty Parlor Kit Assistance Scheme

Eligibility criteria for availing benefit

List of required documents

How to fill online form

Beauty Parlor Kit Assistance 2023

Scheme Name Beauty Parlor Kit Assistance

Under Manav Kalyan Yojana

Financial Assistance Date

Age limit 16 to 60 years

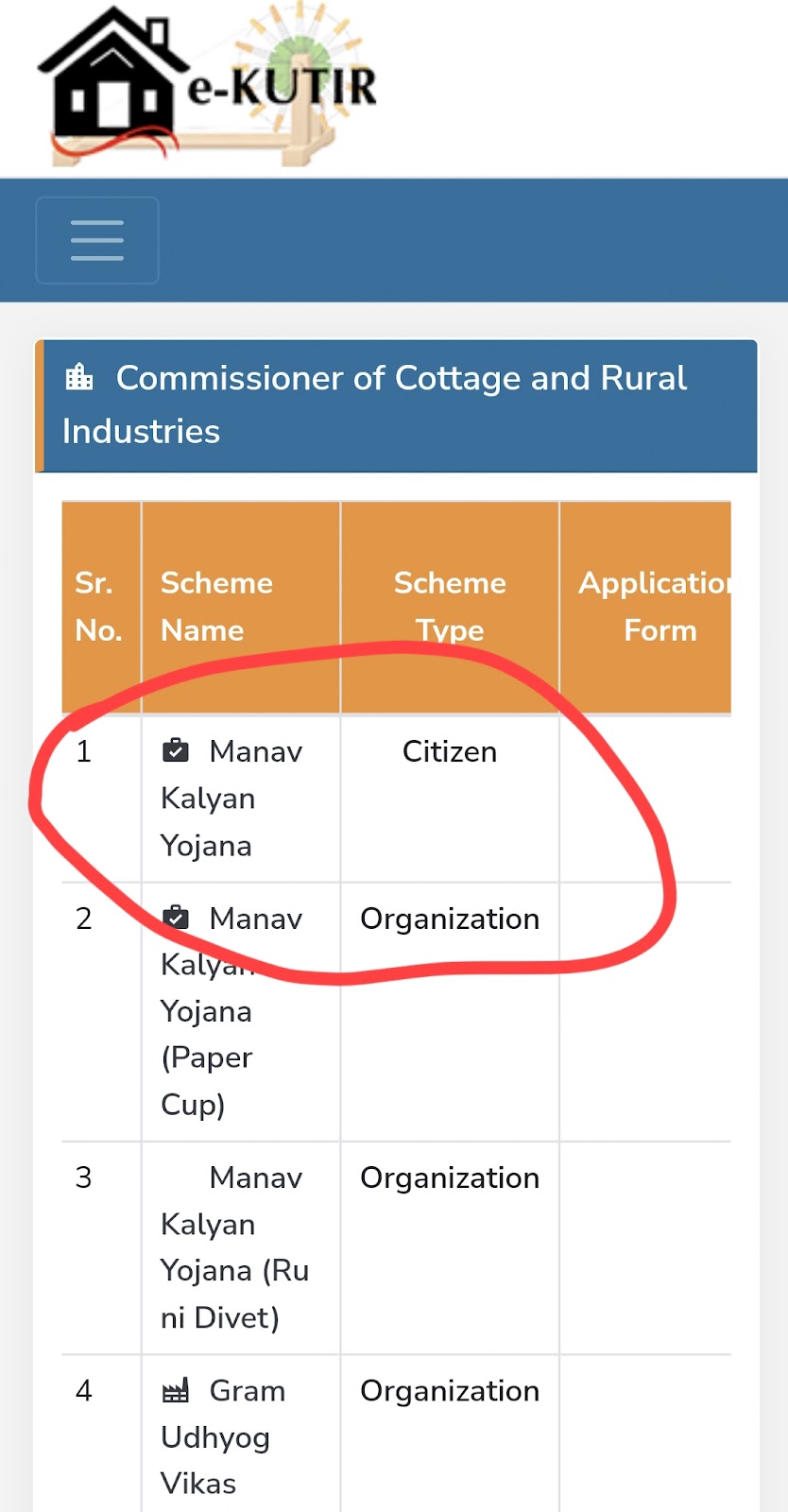

Commissioner Cottage and Village Industries as per the list of dholkit included with the resolutions dated 1/9/18

Beauty Parlor Kit Assistance Scheme

Under Free Beauty Parlor Kit Assistance 2023 by Gujarat Government, laborers and poor women will be able to take care of themselves and their families well by getting free beauty parlor kit. One of the objectives of this scheme is to provide employment to women. Can and can advance their life well Can get your income The benefits of this scheme are eligible to economically weak women and working women of both urban and rural areas of the state whose forms are currently being filled online keeping in mind the interest of women the direct link to fill the online form is given below You can fill the form online from here

HOME LOAN ELIGIBILITY

Home loan eligibility is primarily dependent on income and repaying capacity. Other important factors include the customer’s profile, age at loan maturity, age of property at loan maturity, investment and savings history etc.

Eligibility criteria for availing benefit

Under the Beauty Parlor Kit Sahay Yojana 2023 certain rules have been laid down by the government which are as follows Women applying under this scheme must be between 16 years to 60 years of age Applicant’s family annual income is 1,20,000 for rural area and 1,20,000 for urban

area 1,50,000 Taluka Mamlatdar or Municipal Chief Officer or an authorized official in the Municipal Corporation will have to submit income proof

under this scheme only economically weaker women of the country can fill the form Under

this scheme widows and disabled women can also fill the form

WHY CHOOSE HDFC HOME LOANS?

Attractive interest rates to make your Home Loans affordable and easier on your pocket.

Customized repayment options to suit your needs.No hidden charges.

Expert legal and technical counseling to help you make the right home buying decision.

HDFC Home Loans

At HDFC, we understand that a home is not just a place to stay. It is much more than that. It is a warm little corner of the world that is yours, tailored to your tastes and needs. It is the place where you celebrate the joys, deal with the sorrows and enjoy the journey called life. There is no place like home and with HDFC Home Loans you can gather hopes, achieve your dreams and create memories in your own space.

List of required documents

Applicant’s Aadhaar Card

Birth Certificate

Ration Card

Residence Proof

Mobile Number

Annual Income Certificate Proof of

Education

Vocational Training Proof

If Disabled Medical Certificate

If Widowed Husband’s Death Certificate

How to fill online form

First go to the official website

here home page will open in front of you

in which under citizen login section on home page you have to login by entering your user id password and captcha code

after login you can fill your online application with all required details.

FEES AND CHARGES

Processing Fees & Charges

Processing Fees

Salaried/Self Employed Professional:

Up to 0.50% of the loan amount or ₹3,000 whichever is higher, plus applicable taxes.

Minimum Retention Amount: 50% of applicable fees or ₹3,000 + applicable taxes whichever is higher.

Self Employed Non-Professional:

Up to 1.50% of the loan amount or ₹4,500 whichever is higher, plus applicable taxes.

Minimum Retention Amount: 50% of applicable fees or ₹4,500 + applicable taxes whichever is higher.

Fees On Account Of External Opinion

Fees on account of external opinion from advocates/technical valuers, as the case may be, is payable on an actual basis as applicable to a given case. Such fees is payable directly to the concerned advocate / technical valuer for the nature of assistance so rendered.

Property Insurance

The customer shall pay the premium amounts directly to the insurance provider, promptly and regularly so as to keep the policy / policies alive at all times during the pendency of the loan.

Charges On Account Of Delayed Payments

Delayed payment of interest or EMI shall render the customer liable to pay additional interest up to 24% per annum.

Incidental Charges

Incidental charges & expenses are levied to cover the costs, charges, expenses and other monies that may have been expended in connection with recovery of dues from a defaulting customer. A copy of the policy can be obtained by customers from the concerned branch on request.

Statutory / Regulatory Charges

All applicable charges on account of Stamp Duty / MOD / MOE / Central Registry of Securitisation Asset Reconstruction and Security Interest of India (CERSAI) or such other statutory / regulatory bodies and applicable taxes shall be borne and paid (or refunded as the case may be) solely by the customer. You may visit the website of CERSAI for all such charges at www.cersai.org.in

The customer shall pay the premium amounts directly to the insurance provider, promptly and regularly so as to keep the policy / policies alive at all times during the pendency of the loan.

Charges On Account Of Delayed Payments

Delayed payment of interest or EMI shall render the customer liable to pay additional interest up to 24% per annum.

Incidental Charges

Incidental charges & expenses are levied to cover the costs, charges, expenses and other monies that may have been expended in connection with recovery of dues from a defaulting customer. A copy of the policy can be obtained by customers from the concerned branch on request.

All applicable charges on account of Stamp Duty / MOD / MOE / Central Registry of Securitisation Asset Reconstruction and Security Interest of India (CERSAI) or such other statutory / regulatory bodies and applicable taxes shall be borne and paid (or refunded as the case may be) solely by the customer. You may visit the website of CERSAI for all such charges at www.cersai.org.in

| યોજનાની માહિતી ગુજરાતીમાં વાંચવા માટે | અહીં ક્લિક કરો |

| બ્યુટી પાર્લર કીટ યોજના જાહેરાત વાંચવા માટે | અહીં ક્લિક કરો |

| ઓનલાઇન ફોર્મ ભરવા માટે | અહીં ક્લિક કરો |